The UK government has confirmed a widely expected U-turn related to “high risk” 5G vendors linked to the Chinese state — attributing the policy shift to the US recently imposing tighter sanctions on Huawei’s access to its technologies.

UK digital minister Oliver Dowden told parliament the new policy will bar telcos from buying 5G kit from Huawei and ZTE to install in new network builds from the end of this year. While any of their kit that’s already been installed in UK 5G networks must be removed by 2027.

Although legislation to enable the enforcement of the policy has still to be laid before parliament and could face challenges from MPs who want to seek a more rapid removal of Huawei kit.

Yesterday telco BT warned against any overly rapid rip-out of existing Huawei kit, suggesting it could cause mobile network outages, generate security risks and further delay upgrades to the country’s fiber broadband network which the government included in its manifesto. BT CEO Philip Jansen had suggested an ideal timeframe of seven years to remove existing Huawei 5G kit so the government appears to have served up its best case scenario, while still piling additional cost on next-gen network builds.

Dowden conceded that the new policy will also delay the rollout of UK 5G networks but claimed the government is prioritizing security over economic considerations.

“Clearly since January the situation has changed. On the 15th of May the US Department of Commerce announced that new sanctions had been imposed against Huawei through changes to the foreign direct product rules. This was a significant material change and one that we have to take into consideration,” he told parliament.

“These sanctions are not the first attempt by the US to restrict Huawei’s ability to supply equipment to 5G networks. They are, however, the first to have potentially severe impacts on Huawei’s ability to supply new equipment in the United Kingdom. The new US measures restrict Huawei’s abilities to produce important products using US technology or software.”

Dowden said the National Cyber Security Center had reviewed the new US sanctions and “significantly” changed their security assessment as a result — saying the government would publish a summary of the advice that had led to the policy U-turn when challenged on the U-turn by the shadow digital minister.

“Given the uncertainty this creates around Huawei’s supply chain the UK can no longer be confident it will be able to guarantee the security of future Huawei 5G equipment affected by the change in US foreign direct product rules,” Dowden added.

A Telecoms Security Bill had been slated to be introduced before the summer recess but will now be delayed until autumn given the policy swerve.

In terms of costs and time associated with restricting and then ripping out Huawei kit from UK 5G networks, Dowden suggested it would add between two to three years more to 5G rollouts — and cost up to £2BN.

“We have not taken this decision lightly and I must be frank about the consequences for every constituency in this country,” he said. “This will delay our roll out of 5G. Our decisions in January had already set back that rollout by a year and cost up to a billion pounds. Today’s decision to ban the procurement of new Huawei 5G equipment from the end of this year will delay the rollout by a further year and will add up to half a billion pounds to costs.”

The additional set of requiring operators to rip out existing Huawei 5G kit by 2027 will entail “hundreds of millions of pounds” more to their costs.

“This will have real consequences for the connections on which all our connections relay,” he further cautioned, warning against that going any “faster and further” than the 2027 target — saying to do so would add “considerable and unnecessary” additional costs and delays.

“The shorter we make the timetable for removal the greater the risk of actual disruption to mobile networks,” he also said.

It’s a very significant change of government policy vs the package of restrictions announced in January when Boris Johnson’s government expressed confidence it could manage any risk associated with vendors with deep links to the Chinese state.

And Dowden faced a barrage of questions from opposition politicians about the “screeching U-turn” and the associated delays to the UK’s 5G network infrastructure from not having taken this decision six months earlier.

Shadow digital minister Chi Onwurah said the government’s digital policy lay in tatters — and called for it to set up a multi-stakeholder taskforce to lead the infrastructure charge. “This entire saga has shown that the government cannot sort this mess out on their own,” she said. “We need a taskforce of industry representatives, academics, startups, regional government and regulators to develop a plan which delivers a UK [5G] network capability and security mobile network in the shortest possible timeframe.”

On government backbenches, Dowden’s statement was more broadly welcomed. Although Johnson has faced significant internal opposition from a group of rebel MPs in his own party to his earlier Huawei policy so it remains to be seen whether they can be convinced to back the new package. One rebel MP source, speaking to the Guardian, warned the fight is back on — saying they’ll table amendments to the telecoms security bill to further shrink the timeframe to rip out Huawei kit, including also for 3G and 4G, not just 5G.

On the issue of what’s to be done with kit from high risk vendors that’s in use in non-5G networks, the government sought to slip in another delay today — with Dowden telling parliament the issue “needs to be looked at”, and announcing a “technical consultation with operators to understand their supply chain alternatives”.

“Given there is only one other appropriate scale vendor for full fiber equipment we are going to embark on a short technical consultation with operators to understand their supply chain alternatives. So that we can avoid unnecessary delays to our Gigabit ambitions and prevent significant resilience risks,” he said.

The technical consultation will determine government policy toward Huawei outside 5G networks, Dowden added.

The government has said before it’s taking steps to increase diversification in the supply chain around 5G network infrastructure kit. Dowden reiterated that line today, saying the UK is working with Five Eyes partners to try to accelerate diversification, while tempering the ambition by couching it as a global problem.

Over the longer term he said the UK wants to encourage and support operators to use multiple vendors per network as standard, though again he cautioned that the development of such open RAN networks will take time.

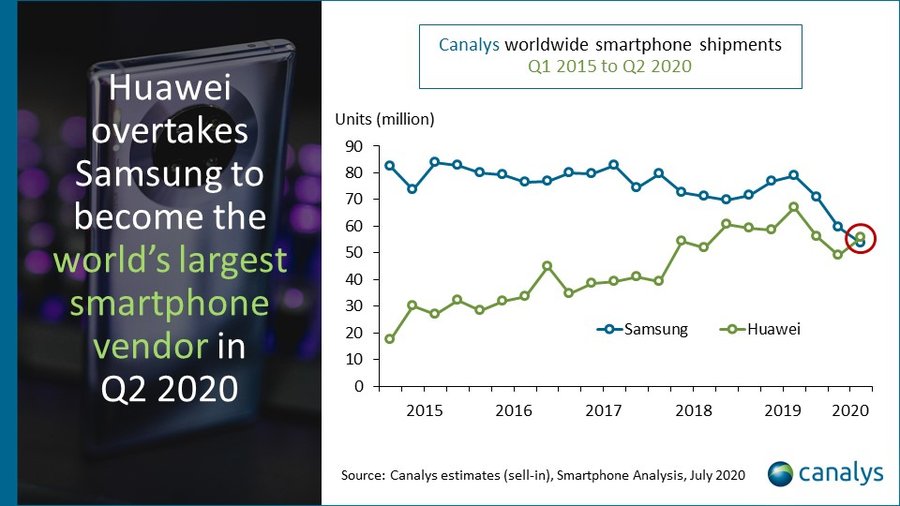

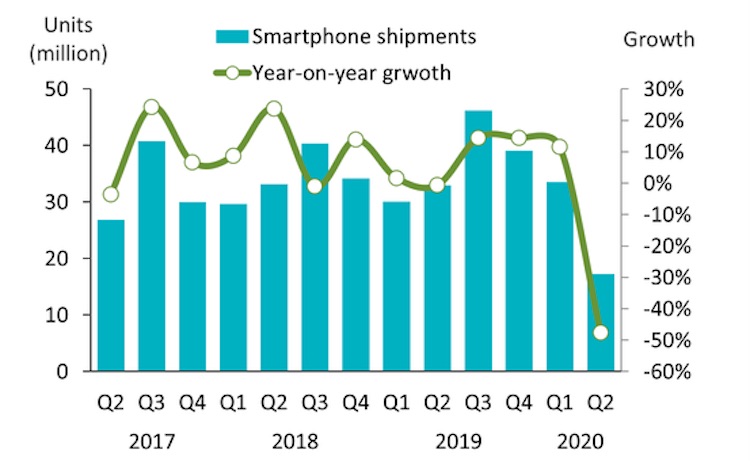

In the nearer, medium term, he suggested other large scale vendors would be needed to step in — saying the government is already having technical discussions with alternative telecoms kit makers, including Samsung and NEC, about accessing the UK market to plug the gap opened up by the removal of Huawei equipment.

“We are already engaging extensively with operators and vendors and governments around the world about supporting and accelerating the process of diversification. We recognize that this is a global issue that requires international collaboration to deliver a lasting solution so we’re working with our Five Eyes partners and our friends around the world to bring together a coalition to deliver our shared goals,” he added.

We’ve reached out to Huawei for comment. Update: In a statement, Ed Brewster, a spokesperson for Huawei UK, told us:

This disappointing decision is bad news for anyone in the UK with a mobile phone. It threatens to move Britain into the digital slow lane, push up bills and deepen the digital divide. Instead of ‘levelling up’ the government is levelling down and we urge them to reconsider. We remain confident that the new US restrictions would not have affected the resilience or security of the products we supply to the UK.

Regrettably our future in the UK has become politicized, this is about US trade policy and not security. Over the past 20 years, Huawei has focused on building a better connected UK. As a responsible business, we will continue to support our customers as we have always done.

We will conduct a detailed review of what today’s announcement means for our business here and will work with the UK government to explain how we can continue to contribute to a better connected Britain.

from blogger-2 https://ift.tt/3gUNbTB

via

IFTTT